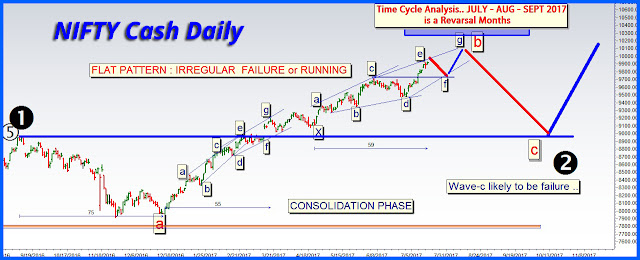

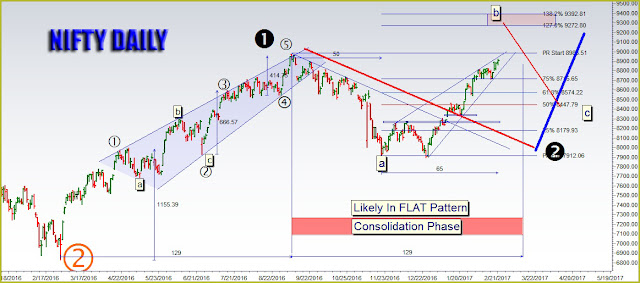

Elliott Wave Analysis for # NIFTY Cash: 9915

As last I discuss in

June 2017, Still Nifty is in a right track to reach 11000-11500…

As concluded in June

2017...Nifty reached 9900 levels..!

Now I discuss here my

further observation about NIFTY with help of ELLIOTT WAVE ANALYSIS….Nothing

major changes…minor wave-b now is in IRREGULAR FAILURE or RUNNING Correction

and some modification In Diametric patterns…as

current minute wave is very strong.

Both charts shows that

Nifty moves in….

|

NIFTY still moving Up in

minor wave-b (in IRREGULAR FAILURE or RUNNING Correction) of intermediate wave

-2nd.

Minor wave-b is running

in a very complex wave –double combination Diametric –X- Diametric is running.

Inside minor wave-b, minute wave-e of 2nd Diametric is running...